The news reports states that college tuition is increasing to $45,000. That’s not the grand total of your four years of “higher education”, but the per year cost of your education. That’s an ending bill of $180,000 if you finish in four or $225,000 in you complete in five. They will tell you it’s not a rush, but with ending debt like that its best to finish and hush. Let’s examine this a little more. An ending debt of $180,000 is worth four luxury cars, 4,500 pair of jeans, and 164 months of rent in a decent housing complex, and a lifetime of low wages and constant phone calls from Sallie Mae asking you, “when will you repay the cost”.  My response is when my salary matches my ending debt. The reality is ridiculous, but oh so true for so many who believed in the promise of a college education and high salaries that don’t come true. To think that my yearly college tuition was $16,500; and that was a lot. $45,000 isn’t reflective of the wages and stress obtained after you are awarded your degree and faced to hit the job market. If I knew what I knew now; college would have been a no go for me.

My response is when my salary matches my ending debt. The reality is ridiculous, but oh so true for so many who believed in the promise of a college education and high salaries that don’t come true. To think that my yearly college tuition was $16,500; and that was a lot. $45,000 isn’t reflective of the wages and stress obtained after you are awarded your degree and faced to hit the job market. If I knew what I knew now; college would have been a no go for me.

We start planning our college experiences as early as freshmen year of high school. Making a list and tweaking it to our liking, but forgetting the hefty financial burden it will place on us and our families. We are influenced that obtaining a college degree is a part of the American dream and a golden ticket towards a greater future. We are encouraged, sometimes forced to apply for the big schools; the ones with the bigger price tickets. Only to find out that scholarships and grants don’t come to frequent. We apply get accepted, apply for scholarships and get rejected, and enter the world of “higher learning” already in debt and feeling the pressure. FAFSA becomes your best friend and your school financial aid office your nightmare; pleading for payment help and scholarships that aren’t there. Already $45,000 in the hole and finally realizing the hope for the dream is gone. Welcome to four years of debt and a lifetime of financial hell.

We leave these institutions in four sometimes five years later. Smiling and happy that classes or over, but frighten about what greets us there. Left to decide grad school or workforce; the question never ending. Until someone tells you, “you won’t make a dime with just a BA in hand”. Grad school applications await you and six months later Sallie Mae greets you asking for her money back while you’re jobless and broke.  What will you do? What is the next step? We enter into Grad school to temporarily silence the debt. That’s their goal to make you believe it will stop, but all it really does is add dollars that we won’t be able to pay back. Oh how I wish things were different. I wish I had a clue on the game called college tuition. You’ve waited four years to graduate and now you’re deep in college tuition debt.

What will you do? What is the next step? We enter into Grad school to temporarily silence the debt. That’s their goal to make you believe it will stop, but all it really does is add dollars that we won’t be able to pay back. Oh how I wish things were different. I wish I had a clue on the game called college tuition. You’ve waited four years to graduate and now you’re deep in college tuition debt.

So you finally land that career job you entered college to pursue and get your first check; welcome to the blues. Tax after tax is taken from your check. This is the salary they said I would get? Where is the rest of my pay and who is this FICA taking my money away? Welcome to Life; where your salary doesn’t match your debt. You will find stress in just thinking that there is no way to pay the $500 monthly fee to repay the man again. Your career is what you hoped for and now it’s yours. You now have a debt of $250,000 and ten years to settle the score. $55,000 a year and $250,000 to repay; I guess this dream has become a nightmare that I wish I never fell asleep to get.

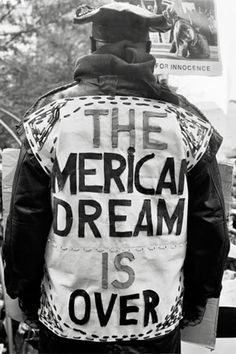

We face this problem of college debt and oh how I wish I never chose this path. I loved my college experiences, but the debt is far more than I can handle. Three pieces of paper that state I have earned a degree, but I now think that I paid for that paper that was never meant for me. Now stuck in another program, trapped by the hands of those in power. Debt rising for a degree I want no more or desire. Educate the young people in your life and provide them with choices. Remember a debt of $180,000 could be invested into a business that produces more happiness than loan debt remorse. If I knew what I knew now I would have stopped a long time ago, because I see my education means nothing and my degrees only make me more useless to the men above me. I am a man, BLACK with knowledge, three degrees later and I still unqualified. I should have traded my seat in college for the stage and maybe I wouldn’t be left feeling this way. They told me that career had no potential for good money, but the one I have now makes no money. I went along for the ride and entered the debt world cries. College debt is scary and real, but it’s the only way the government can keep encouraging us to believe while making it harder for us to achieve. The American dream, turned out to be my nightmare.

I am a man, BLACK with knowledge, three degrees later and I still unqualified. I should have traded my seat in college for the stage and maybe I wouldn’t be left feeling this way. They told me that career had no potential for good money, but the one I have now makes no money. I went along for the ride and entered the debt world cries. College debt is scary and real, but it’s the only way the government can keep encouraging us to believe while making it harder for us to achieve. The American dream, turned out to be my nightmare.

Mood: Why oh why did I participate in the American race?